Can Gym Membership Be A Business Expense Uk . paying for personal gym memberships through your limited company is generally not allowable as for most. can you claim your gym membership as a business expense through your company? although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. But most of the time, gym membership is deemed a personal expense by hmrc. Below is an overview of. can i claim my gym membership as a business expense ? Sadly, the short answer to this question is “no. You can technically expense anything as long as you can prove that it’s a business expense. in short, it depends. Hmrc considers a gym membership to be a personal expense rather than a business expense. Unfortunately, the short answer is no.

from www.examples.com

Hmrc considers a gym membership to be a personal expense rather than a business expense. But most of the time, gym membership is deemed a personal expense by hmrc. Unfortunately, the short answer is no. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. in short, it depends. paying for personal gym memberships through your limited company is generally not allowable as for most. can i claim my gym membership as a business expense ? can you claim your gym membership as a business expense through your company? You can technically expense anything as long as you can prove that it’s a business expense. Below is an overview of.

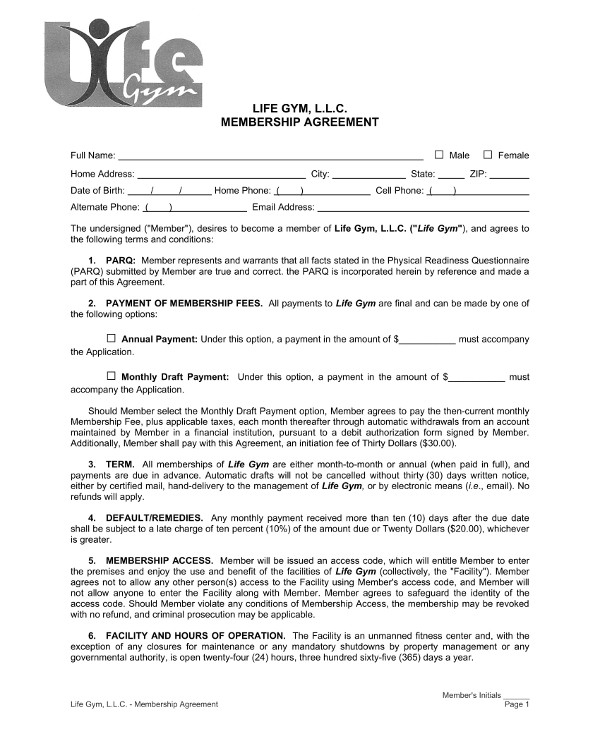

Gym Membership Contract 11+ Examples, Format, Pdf, Tips

Can Gym Membership Be A Business Expense Uk in short, it depends. paying for personal gym memberships through your limited company is generally not allowable as for most. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. can i claim my gym membership as a business expense ? Hmrc considers a gym membership to be a personal expense rather than a business expense. Below is an overview of. But most of the time, gym membership is deemed a personal expense by hmrc. Sadly, the short answer to this question is “no. You can technically expense anything as long as you can prove that it’s a business expense. can you claim your gym membership as a business expense through your company? in short, it depends. Unfortunately, the short answer is no.

From www.pinterest.co.uk

Gym Membership Invoice Template Can Gym Membership Be A Business Expense Uk can you claim your gym membership as a business expense through your company? Sadly, the short answer to this question is “no. in short, it depends. paying for personal gym memberships through your limited company is generally not allowable as for most. Hmrc considers a gym membership to be a personal expense rather than a business expense.. Can Gym Membership Be A Business Expense Uk.

From www.someka.net

Gym Financial Model Excel Template Gym Feasibility Study Tool Can Gym Membership Be A Business Expense Uk You can technically expense anything as long as you can prove that it’s a business expense. Unfortunately, the short answer is no. paying for personal gym memberships through your limited company is generally not allowable as for most. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as. Can Gym Membership Be A Business Expense Uk.

From www.cfotemplates.com

Gym Financial Plan Can Gym Membership Be A Business Expense Uk although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. But most of the time, gym membership is deemed a personal expense by hmrc. in short, it depends. can you claim your gym membership as a business expense through your company? Sadly, the short answer. Can Gym Membership Be A Business Expense Uk.

From learningschoolenrichifa.z22.web.core.windows.net

Schedule C And Expense Worksheet Can Gym Membership Be A Business Expense Uk Below is an overview of. can i claim my gym membership as a business expense ? But most of the time, gym membership is deemed a personal expense by hmrc. Hmrc considers a gym membership to be a personal expense rather than a business expense. You can technically expense anything as long as you can prove that it’s a. Can Gym Membership Be A Business Expense Uk.

From www.cashnetusa.com

The Price of a Gym Membership Around the World Blog Can Gym Membership Be A Business Expense Uk can i claim my gym membership as a business expense ? Hmrc considers a gym membership to be a personal expense rather than a business expense. paying for personal gym memberships through your limited company is generally not allowable as for most. in short, it depends. Sadly, the short answer to this question is “no. But most. Can Gym Membership Be A Business Expense Uk.

From www.stampli.com

Track Small Business Expenses in 5 Easy Steps Can Gym Membership Be A Business Expense Uk although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. can i claim my gym membership as a business expense ? Below is an overview of. in short, it depends. But most of the time, gym membership is deemed a personal expense by hmrc. You. Can Gym Membership Be A Business Expense Uk.

From dxopaigqt.blob.core.windows.net

Example Of Business Fixed Expenses at Janita Waller blog Can Gym Membership Be A Business Expense Uk Unfortunately, the short answer is no. can i claim my gym membership as a business expense ? can you claim your gym membership as a business expense through your company? Sadly, the short answer to this question is “no. although the cost of providing access to a phone or vehicle intended solely for business use can be. Can Gym Membership Be A Business Expense Uk.

From financesonline.com

87 Gym Membership Statistics You Must Learn 2024 Cost, Demographics Can Gym Membership Be A Business Expense Uk Unfortunately, the short answer is no. can you claim your gym membership as a business expense through your company? paying for personal gym memberships through your limited company is generally not allowable as for most. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company.. Can Gym Membership Be A Business Expense Uk.

From www.sampletemplates.com

FREE 12+ Gym Membership Receipt Samples & Templates in PDF MS Word Can Gym Membership Be A Business Expense Uk You can technically expense anything as long as you can prove that it’s a business expense. paying for personal gym memberships through your limited company is generally not allowable as for most. Below is an overview of. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a. Can Gym Membership Be A Business Expense Uk.

From thefitnessblogger.com

Can Gym Membership Be A Business Expense Can Gym Membership Be A Business Expense Uk in short, it depends. can i claim my gym membership as a business expense ? Below is an overview of. can you claim your gym membership as a business expense through your company? although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. But. Can Gym Membership Be A Business Expense Uk.

From template.mapadapalavra.ba.gov.br

Gym Membership Template Can Gym Membership Be A Business Expense Uk Sadly, the short answer to this question is “no. Unfortunately, the short answer is no. paying for personal gym memberships through your limited company is generally not allowable as for most. Below is an overview of. You can technically expense anything as long as you can prove that it’s a business expense. can you claim your gym membership. Can Gym Membership Be A Business Expense Uk.

From www.pushpress.com

3 Must Have Revenue Streams In Your Gym Business Can Gym Membership Be A Business Expense Uk can you claim your gym membership as a business expense through your company? Below is an overview of. Sadly, the short answer to this question is “no. But most of the time, gym membership is deemed a personal expense by hmrc. Hmrc considers a gym membership to be a personal expense rather than a business expense. can i. Can Gym Membership Be A Business Expense Uk.

From www.eloquens.com

Gym Budgeting Excel Template Eloquens Can Gym Membership Be A Business Expense Uk Sadly, the short answer to this question is “no. can you claim your gym membership as a business expense through your company? You can technically expense anything as long as you can prove that it’s a business expense. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as. Can Gym Membership Be A Business Expense Uk.

From www.coachmmorris.com

Can A Gym Membership Be A Business Expense Coach M Morris Can Gym Membership Be A Business Expense Uk You can technically expense anything as long as you can prove that it’s a business expense. Hmrc considers a gym membership to be a personal expense rather than a business expense. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. paying for personal gym memberships. Can Gym Membership Be A Business Expense Uk.

From www.someka.net

Gym Financial Model Excel Template Gym Feasibility Study Spreadsheet Can Gym Membership Be A Business Expense Uk paying for personal gym memberships through your limited company is generally not allowable as for most. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. in short, it depends. Hmrc considers a gym membership to be a personal expense rather than a business expense.. Can Gym Membership Be A Business Expense Uk.

From www.someka.net

Gym Financial Model Excel Template Gym Feasibility Study Tool Can Gym Membership Be A Business Expense Uk Unfortunately, the short answer is no. although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. Below is an overview of. in short, it depends. Sadly, the short answer to this question is “no. Hmrc considers a gym membership to be a personal expense rather than. Can Gym Membership Be A Business Expense Uk.

From www.tide.co

What expenses can I claim as a limited company? Tide Business Can Gym Membership Be A Business Expense Uk can you claim your gym membership as a business expense through your company? You can technically expense anything as long as you can prove that it’s a business expense. Unfortunately, the short answer is no. Hmrc considers a gym membership to be a personal expense rather than a business expense. Below is an overview of. But most of the. Can Gym Membership Be A Business Expense Uk.

From www.pinterest.co.uk

21 Powerful Gym Membership Retention Strategies That Really Work Can Gym Membership Be A Business Expense Uk although the cost of providing access to a phone or vehicle intended solely for business use can be claimed as a company. Below is an overview of. Sadly, the short answer to this question is “no. can i claim my gym membership as a business expense ? Unfortunately, the short answer is no. paying for personal gym. Can Gym Membership Be A Business Expense Uk.